Understand the BBPS Ecosystem: Exploring the Role of a Payment API Provider

In today's digital age, the way we manage our bills and payments has undergone a significant transformation. The traditional methods of bill payment, such as standing in long queues or manually processing payments, are gradually being replaced by more convenient and efficient solutions. One crucial element in this transformation is the emergence of Recharge API (Application Programming Interface) provider companies that play a pivotal role in enabling seamless bill payment experiences. Here we are going to delve into the world of bill payment ecosystem transformation and explore the vital role of a BBPS API provider company in revolutionizing the process.

Understanding The Utility Bill Payment Landscape

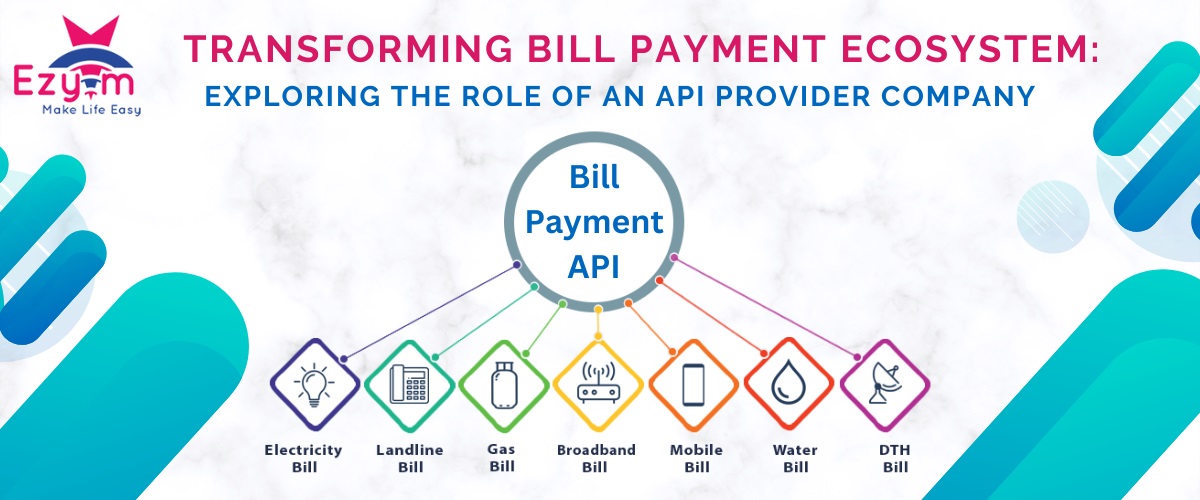

Utility bill payments, including electricity, water, gas, and more, are recurring obligations for individuals and businesses alike. Historically, these payments involved manual efforts, multiple visits to payment centres, and complex paperwork. However, with the advent of digitalization, utility bill payment processes have become increasingly streamlined and user-friendly. Today, individuals can conveniently pay their bills from the comfort of their homes or on the go, thanks to the integration of BBPS (Bharat Bill Payment System) APIs.

What Is BBPS API?

BBPS API refers to the Application Programming Interface that facilitates bill payments through the Bharat Bill Payment System. BBPS is an interoperable bill payment system that enables customers to pay various utility bills using a single platform. It eliminates the need for multiple bill payment channels, providing a unified and standardized solution. BBPS API enables businesses to integrate bill payment services seamlessly into their applications, websites, or mobile platforms.

How Does A Payment API Work?

A Payment API (Application Programming Interface) facilitates the integration of payment functionality into applications, websites, or other software systems. It enables developers to connect their applications to payment gateways or processors, allowing them to initiate and process payment transactions. Here's a high-level overview of how a Payment API typically works:

- Integration: Developers integrate the Bill Payment API into their applications by incorporating the necessary code and configurations. This usually involves registering with the payment service provider, obtaining API keys or credentials, and configuring the API endpoints.

- Request generation: When a user initiates a payment transaction within the application (e.g., making a purchase or submitting a payment), the application sends a request to the Payment API. The request typically includes information such as the transaction amount, customer details, and any other relevant data.

- Encryption and security: To ensure secure transmission of sensitive payment data, the Payment API employs encryption protocols (such as SSL/TLS) to encrypt the data being sent between the application and the payment gateway. This ensures that customer payment information is protected during transmission.

- Forwarding to the payment gateway: The Payment API forwards the payment request to the associated payment gateway or processor, which acts as an intermediary between the application and the financial institution. The payment gateway facilitates communication with the financial institution for processing the payment.

- Authentication and authorization: The payment gateway validates the request by authenticating the application and verifying the provided credentials or API keys. This step ensures that only authorized applications can access and use the Payment API.

- Payment processing: Once the request is authenticated and authorized, the payment gateway communicates with the relevant financial institution (such as a bank) to process the payment. The financial institution checks the customer's account balance, verifies the transaction details, and performs other necessary checks.

- Transaction response: The financial institution sends a response back to the payment gateway, indicating the status of the transaction. This response typically includes information such as whether the payment was successful, declined, or encountered an error.

- Response forwarding: The Payment API receives the response from the payment gateway and forwards it back to the application. The application can then handle the response accordingly, updating the user interface, generating receipts, or triggering any necessary follow-up actions.

- Error handling and notifications: In case of errors or declined transactions, the Payment API may provide error codes or messages to help the application handle and communicate the issue to the user. Additionally, the Payment may support notifications or webhooks to notify the application of transaction status updates in real-time.

- Reporting and reconciliation: The Payment API often provides reporting and reconciliation features, allowing the application to retrieve transaction data, generate reports, and reconcile payments. This helps in monitoring and managing payment activities within the application.

It's important to note that the specifics of a Payment API can vary depending on the payment service provider or processor being used. Different providers may have their own specific API documentation, integration requirements, and supported features.

Roles Of A BBPS API Provider Company In Transforming The Bill Payment Ecosystem:

A BBPS API provider company serves as a crucial link between bill payment service providers, such as utility companies, and businesses or developers seeking to integrate bill payment services. Here are some key aspects highlighting the role of a BBPS API provider company in transforming the bill payment ecosystem:

1. Comprehensive Integration:

A reliable BBPS API provider company offers comprehensive integrated solutions to businesses and developers. They provide a set of well-documented APIs, SDKs (Software Development Kits), and developer resources that facilitate the smooth integration of bill payment services into various platforms. This integration empowers businesses to offer their customers a unified and hassle-free bill payment experience.

2. Wide Range of Billers:

A BBPS API provider company partners with a vast network of billers, including utility companies, telecom operators, insurance providers, and more. By integrating with a BBPS API, businesses gain access to this extensive network, enabling their customers to pay bills to multiple service providers through a single interface. It eliminates the need for customers to navigate multiple payment channels and simplifies their bill payment process.

3. Robust Security and Compliance:

Utility bill payment transactions involve sensitive customer data and financial information. A reputable BBPS API provider company ensures the highest standards of security and compliance. They implement robust encryption protocols, adhere to industry regulations, and comply with data privacy laws. This gradually but firmly establishes trust in businesses and customers, making them confident in utilizing the bill payment services offered.

4. Scalability and Reliability:

A reliable Utility bill payment and Recharge API provider company offers a scalable infrastructure to handle high transaction volumes seamlessly. They provide robust servers and backend systems that can accommodate rapid growth and fluctuations in demand. This scalability ensures uninterrupted bill payment services, minimizing downtime and enhancing customer satisfaction.

5. Innovation and technology advancements

BBPS API providers constantly explore and adopt new technologies and innovations to enhance the bill payment ecosystem. They keep abreast of emerging trends, such as mobile payments, digital wallets, and other convenient payment methods, integrating them into their offerings to provide a cutting-edge experience to customers and stakeholders.

6. Value-added Services:

Beyond basic bill payment functionality, a BBPS API provider company often offers additional value-added services. These may include features such as bill reminders, payment history tracking, real-time notifications, and analytics. By leveraging these services, businesses can enhance the overall customer experience and differentiate themselves in the competitive market.

7. Analytics and reporting:

The API provider offers analytics and reporting features to billers, enabling them to gain insights into customer behaviour, payment patterns, and other relevant metrics. This helps billers optimize their services, tailor offerings, and improve overall operational efficiency.

8. Transaction tracking and reconciliation:

The API provider facilitates transaction tracking and reconciliation for both billers and customers. They provide tools and systems that enable real-time monitoring of payment status, ensuring transparency and accuracy in the payment process. This also ensures that the biller receives the payment instantly. This eliminates delays and reduces the chances of payment failures or disputes, thereby improving the efficiency of the bill payment ecosystem.

9. Enhanced customer experience:

By offering a unified interface for bill payments, the API provider enhances the overall customer experience. Customers can conveniently view and pay their bills through multiple channels like mobile apps, websites, or even physical touchpoints like bank branches or retail outlets.

Conclusion:

The role of an API provider company is pivotal in transforming the utility bill payment ecosystem. Through their innovative solutions and robust mobile recharge software offerings, these companies enable seamless integration between various stakeholders, revolutionizing the way bills are paid and managed.

By leveraging APIs, businesses can enhance customer experiences by providing convenient bill payment options across multiple channels. This allows users to settle their bills through their preferred platforms, such as mobile apps, websites, or even voice assistants, without the need for manual intervention. The API provider company acts as a bridge, connecting payment processors, billing systems, and financial institutions, ensuring secure and reliable transactions.